Wednesday, June 24, 2009

Ready-to-eat, a growing sector

Monsanto, Dole in 5-Year Vegetable Collaboration

Reuters - June 23, 2009

Chicago - Monsanto Co and Dole Fresh Vegetables Inc said on Tuesday that they would collaborate to develop vegetables that could be more attractive to consumers.

Monsanto and Dole said they would use plant breeding to improve the nutrition, flavor, color, texture, taste and aroma of the vegetables. The five-year collaboration will focus on broccoli, cauliflower, lettuce and spinach, the companies said. If new products were created under the collaboration, they could be commercialized by Dole in North America.

Tuesday, June 23, 2009

Loosing pounds, not so healthy after all for British consumers…

by David Ivanovic

The staggering numbers extracted from Eurostat show an important decrease in EU imports of horticultural products. Let’s cut straight to the point: the recession that is engulfing the majority of European countries is one, if not the major underlying reason. Another cause behind the reduction of imported fresh products, especially in Great Britain, is the devaluation of the British pound, which has lost a 25% of its value in 2008 against the euro. At the beginning of last year, 100 pounds could get you almost 140 euros; on New Year’s Eve, the same amount was only worth €100.

This week, the pound regained its November value, climbing up by 15% since its all time low value of January. Let’s see if the growth momentum will keep going and bring back the levels of imports to what they used to be. Because when someone stops buying, someone at the other end of the supply chain is having a hard time too. Eating more mangoes and papayas will be good for everyone.

Monday, June 22, 2009

Recession hits UK exotics consumption

June 22, 2009 - Reefer Trend

The sales value of tropical fruits such as pineapples, mangoes and melons has dropped by 5.5% with volumes falling even more steeply

UK: Co-op uses new labelling to promote eco-awareness

The Co-op has introduced new labelling on bags used to store fresh produce, detailing how to best keep them for maximum freshness and longevity. This eco-friendly initiative is part of the Love Food Hate Waste project launched by the government. Like other retailers - perhaps Marks and Spencer most notably - Co-op is waging a war on waste. British consumers ... read more...

The range of fair trade, sustainable products in EU retailers is insufficient

European consumers are dissatisfied with the availability of environmentally friendly or ethically produced products, according to the latest European Commission's survey on consumers satisfaction just released. The detailed reports published this week by the European Commission’s Directorate General for Health and Consumers on consumer satisfaction cover different product sectors (8 total) throughout ... read more...

Friday, June 19, 2009

A tough start for papaya imports in 2009 (correction)

by David Ivanovic – June 18, 2009

There was a slight mistake in my table (the years were wrong!) Here’s the good one.

Thursday, June 18, 2009

A tough start for papaya imports in 2009

by David Ivanovic – June 18, 2009

Between January and March this year, total shipments to EU countries are down by 19% in comparison with the same period in 2008, from 8,900 to 7,150 metric tonnes. Except for Ivory Coast, Pakistan and India, the majority of fresh papaya suppliers have been hit by lower demand.

Figures represent direct imports from non-European countries to the EU15, and therefore do not take into account shipments within Europe (for instance, between Netherlands and Germany).

EU15 Papaya Imports in 2008

by David Ivanovic

Imports of fresh papayas by the EU15 totalled 37,293 tons in 2008, up by 2.5% from levels recorded in 2007, despite important drops from Brazilian (-6%) and Ecuadorian suppliers (-23%).

Papayas from Cote d’Ivoire increased by nearly 100% between the two years, securing 10% of the market share in Europe.

Papayas from Cote d’Ivoire increased by nearly 100% between the two years, securing 10% of the market share in Europe.

Wednesday, June 17, 2009

24 EU Countries to Start School Fruit and Vegetable Snack Programs

Creating a huge opportunity for the fresh and fresh-cut produce industry to capitalize on sales to schools, the European Commission's DG-AGRI is making €90 million available annually as matching funds for EU countries to provide daily fruit and vegetable snacks to school children. 24 of the 27 EU countries submitted applications this week for portions of that funding to either start or expand School Fruit and Vegetable Schemes in their countries by the start of the school year ... read more ...

Tuesday, June 16, 2009

Fresh tomato imports in 2008

by David Ivanovic - June 16, 2009

For the year 2008, EU15 countries imported a total of 331,258 tons of fresh tomatoes, with a CIF value of €261 millions.

Out of that impressive figure, 90% were supplied by Morocco. More than 80% of the North African origin went to France, while 10% were imported by Spain.

EU Banana Imports: Latin America Stronger than Ever!

by David Ivanovic – June 16, 2009

Impressive Eurostat numbers, at least for your humble “data cruncher”, are showing no signs of slowing down in the European banana business. In 2008, 4.6 million tons have been imported by the EU15 countries; import volumes (from non-European origins) have grown by more than 36% between 2004 and 2008. The banana “oligarchy” (70% of total imports controlled by Colombia, Ecuador and Costa Rica) continues to maintain and increase its presence, and European demand shows no sign of wading.

As Colombian shipments arrived at a rate of 17% annually (!), volumes from West Africa (Cameroon and Cote d’Ivoire) have rebounded in 2008, surpassing for the first time the levels recorded five years ago.

Friday, June 12, 2009

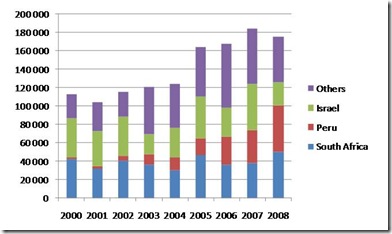

Avocado Imports from Non-European Origins, 2000-2008

by David Ivanovic

EU-15 imports have fresh avocadoes have experienced a very important rise over the last years, from levels around 100,000 tons in the early 2000s to 180,000 t. last year.

Monday, June 8, 2009

EU Pineapple Imports in 2008 / 1st part

by David Ivanovic

In 2008, pineapple imports for the EU-15 have witnessed another big jump in terms of pineapple shipments. Between 2004 and 2008, arrivals have grown by nearly 80%, representing an annual growth rate of 15%.

Costa Rica is the main locomotive in this highly competitive market, growing from 250,000 metric tonnes in 2004 to 670,000 four years later. Latin American suppliers are confirming their leaderships while traditionnal West African suppliers are progressively switching their products from Smooth Cayenne to MD-2 varieties.

In 2008, pineapple imports recorded a CIF value of €595 million.

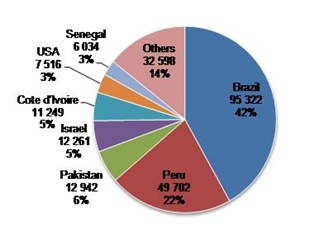

EU Mango Market Share in 2008

by David Ivanovic

In 2008, Brazil was once more the most important suppliers of fresh mangoes to the EU-15 countries. More than 95,000 metric tonnes, or roughly 40% of total imports, originated from this origin.

Tuesday, June 2, 2009

Ireland: Fyffes expands pineapple operations

Fyffes is buying the assets from Agroindustries Golden West (GOPA). The operation covers around 450 hectares.

Fyffes says that, combined with its existing pineapple farms in Costa Rica, it expects to be the direct producer of around 50% of the pineapples it markets in 2010.

Advertisement

The cost of the deal includes debt acquired and deferred payments.

Source: rte.ie

Publication date: 5/12/2009

Philippines: Mindanao’s pineapple export sales rise 42%

Pineapple export sales last year were 42.17% more than the previous year’s $247.8 million, the Bureau of Agricultural Statistics said in a report released recently.

The United States and Japan, two of the countries affected by the global financial turmoil, bought at least 60% of the country’s pineapple exports in 2008. Japan took the bulk of fresh pineapple, while the US bought canned products.

The volume of exports reached 809,315 metric tons (MT) in 2008, up 37.36% from the previous year’s 589,206 MT.

Mindanao produces nearly 90% of the country’s pineapples, a large part of which comes from Northern Mindanao (Region 10) and Central Mindanao (Region 12 or Soccsksargen), specifically in the form of canned products.

Northern Mindanao is home to the pineapple farms of Del Monte Philippines, Inc., while Region 12 hosts Dole Philippines, Inc. (Dolefil).

The Davao Region also exports mostly fresh pineapple to Japan.

Pineapple production in 2008 rose by 9.6% to 2.2 million MT from 2 million MT the previous year. "The gain was attributed to area expansion in Northern Mindanao and Soccsksargen. Producers were encouraged by the increasing market demand," the report explained.

Area planted to pineapple rose to 58,000 hectares from 54,000 hectares in 2007.

Source: bworldonline.com

Publication date: 5/20/2009

Spain, Imports from non-EU countries on the rise

Spanish imports of fruits and vegetables in 2008 stood at 2.6 million tons, of which 1.5 million were imported from the EU (59.2% of the total) while 1.06 million tonnes corresponded to products from non-EU countries, 40.7% of the total. Five years ago, in 2004, the EU accounted for 66.7% of Spanish imports and third countries 33.2%.

The share of non-EU countries in the Spanish import market is higher for fruits than for vegetables. Spanish fruit imports in 2008 amounted to 1.3 million tons, of which 65% (848,047 tonnes) from countries outside the EU, while 456,275 tons were from EU countries.

The main fruits imported to Spain are citrus, apples, bananas, pineapple and kiwifruits. For all these products the major suppliers are non-EU countries, especially Latin America, except for apples, that are imported mostly from France. In Spain imports from third countries account for 79% of the total for citrus fruits, 87% for bananas, 50% for kiwifruits and 81% for pineapple.

Spanish vegetable imports in 2008 amounted to 1.3 million tons, of which 221,183 tonnes, 17% of the total, were from third countries, according to data from the Directorate General of Customs in Spain, processed by FEPEX.

Source: fruttaonline.it

Publication date: 5/25/2009